In the last issue of Step Matters (Issue 178, p1–2) the possible merger of Ku-ring-gai and Hornsby Councils was discussed.

The data in the article implied that average property land values in Ku-ring-gai are about 50% higher than in Hornsby and inferred rightly that this would lead to an increase in rates in Ku-ring-gai unless there were significant cost savings. Fair comment but one must be cautious about averages in understanding the issue from the point of view of the typical (or median) ratepayer.

Rating Structure

A complication here is that Ku-ring-gai has moved away significantly from ordinary rates to an environmental levy which is paid in two parts – a minimum, which all rate payers pay and a pro-rata element. This has the effect of increasing the amount apartment owners pay compared to previous arrangements.

Hornsby rates excluding domestic water management charges were $451 per head of population in 2013–14, Ku-ring-gai’s $523. If a levelling off occurs Ku-ring-gai ratepayers will benefit.

This is simplistic in that the rates include business rates. Councils no longer provide data on the total paid by businesses but a guide is available from history.

In 2007–08 Hornsby’s business rates in total were 13% of residential rates, Ku-ring-gai’s 7%. This doesn’t place Hornsby in the North Sydney category for business rating resulting in low residential rating but is worthy of note.

Relative Financial Position

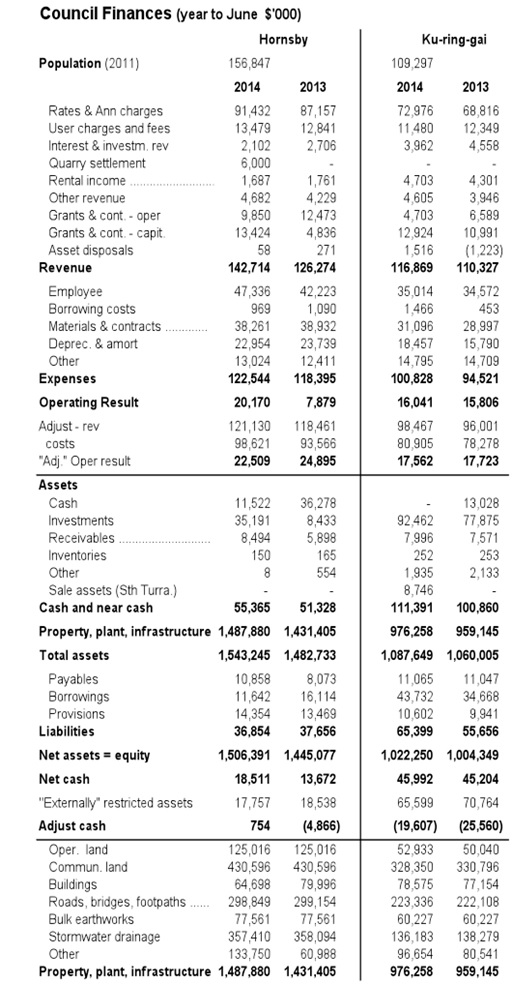

Below is a summary of the two councils’ financial results for 2013–14 with comparisons with the preceding year.

Let’s start with the operating result. Please, dear reader, do not read this as if were for BHP. Councils are not profit making entities, they are public sector spending bodies. The bottom line or so called operating result provides an indication of the surplus that’s available for capital expenditure, loan repayments or cash build ups. Councils typically use rates as a funding source for capital expenditure and also to service debt.

It helps to assess this if we make some adjustments by excluding capital grants (mainly section 94 developer contributions) and interest on the revenue side and depreciation etc on the expense side. Also excluded as it’s a once off is the Hornsby Quarry legal settlement of $6m.

On this basis the results for the two councils are similar given their populations.

The most interesting aspect of the balance sheet is the amount of net cash (assets less liabilities) that the two councils might contribute to the merger. Based on 30 June 2014 data Ku-ring-gai will contribute much more than Hornsby.

Restricted Assets

However, it may be appropriate to adjust for external restricted assets as this money may be quarantined to respective council areas.

What is a restricted asset you ask? A restricted asset is cash on-hand, receivable or invested that has been received from a contributor or government but not yet spent. This is a quirk of local government accounting. When STEP receives a grant it is shown as a liability until spent. Councils do not do this.

Councils also have internally restricted assets and it is certainly arguable that the adjustment should reflect these. For the record Ku-ring-gai’s internally restricted assets as at 30 June 2014 amounted to $23m over half of which related to infrastructure and facilities. Hornsby’s figure was the same – $23m.

The key to the external restrictions is Section 94 Developer Contributions. At the end of June 2014 Ku-ring-gai had $60.5m of these contributions not yet spent, Hornsby $14.4m. This is a significant difference.

The quarantining of these contributions to old council areas after merger may not work totally as expected as the merged council may be influenced in how general funds are spent having regard to the section 94 situation.

When adjusted for external restricted assets both councils would contribute negative cash, Ku-ring-gai more so.

Note that Ku-ring-gai’s cash includes the value of land in South Turramurra held for resale ($8.7m). The Council would almost certainly wish to have pointed out that they have an asset sale program in place to improve their cash position further.

Infrastructure Provisions

An important issue for any organisation with significant long-term assets is the state of repair of those assets. One doesn’t go to the accountant’s office to find out about this; the only realistic way is to survey the assets.

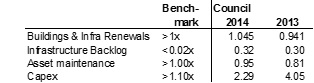

In recent years various ratios have been developed to address this issue. For Ku-ring-gai the relevant ones are shown below.

Not one of these is intuitive. They all depend on quite arbitrary assessments or estimates. More information is in the Annual Report, p175.

Worthy of comment is the backlog ratio where Ku-ring-gai is way off the benchmark. The ratio is an estimate of the amount needed to be spent on infrastructure to bring it to an acceptable standard divided by the value of the infrastructure. Who does the estimating? How do you ensure there is no gold plating?

Hornsby doesn’t calculate these ratios.

At the foot of the financials table is a breakup of the property, plant, and infrastructure line.

Hornsby has a very large figure for stormwater drainage; it’s even greater than that for roads. Part of the reason for this is that Hornsby uses a much lower rate of depreciation for this asset class than Ku-ring-gai. This only goes to emphasise just how rubbery much of this infrastructure data is. Indeed there’s a major problem of determining what is operating expenditure (maintenance) and what is capital.

Be careful what you read in the newspapers. On 27 January the Sydney Morning Herald stated, quoting Northern Mayors, that ‘metro councils had a combined operating surplus in excess of $20 million’ (p23). Rubbish.

Survey Results

In Issue 178 of STEP Matters we invited members to answer survey questions about council merger proposals. The response was small but all respondents were against the idea of council amalgamations. There were mixed views on whether mergers should be an election issue or whether a referendum should be held. Basically it was considered that the political process would bury the issue within a multitude of other considerations. The alternative is for the public to be given the opportunity to make submissions that can cover the issues in detail.

Currently all councils are preparing the Fit for Future reports required by the state government and the reports I have seen claim that all councils in our area are ‘fit’ and they do not support merger.